Top Marginal Tax Rates Have Dropped, Americans Consistently Think They Pay Too Much By Luke Perry and Taylor Raga

Income tax began temporarily during the Civil War. A flat tax of two percent on incomes exceeding $4,000 became the first peacetime income tax in 1894. The passage of the Sixteenth Amendment in 1913 solidified income tax as a permanent feature of paying taxes.

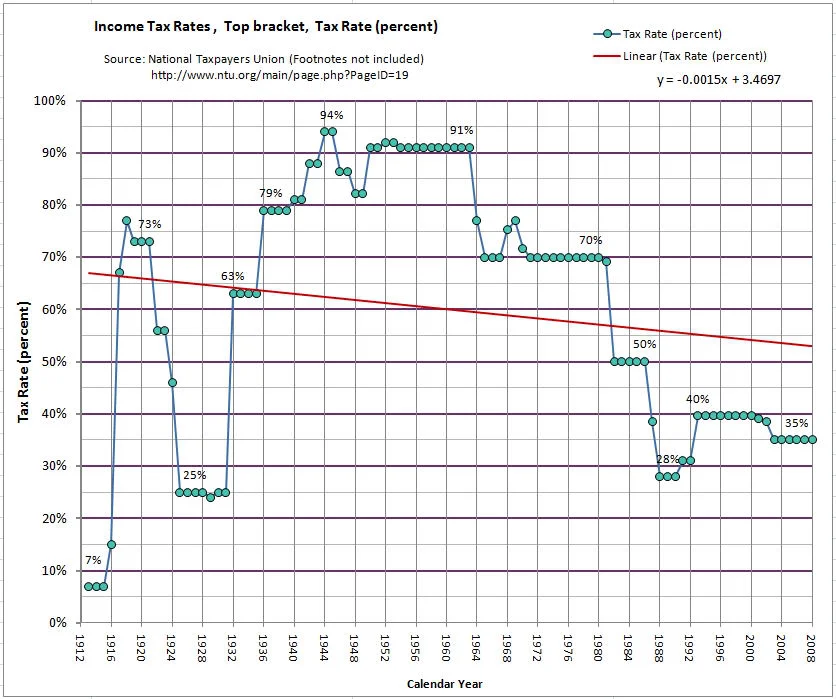

Individual income tax rates used to be much higher than they are today. The top individual income tax rate was 77 percent during World War I. The top income tax rate was over 90 percent during the 1950s. The top rate has declined since 1964, most notably during the 1980s, when it fell below 50 percent, and bottomed out at 28 percent in 1988. The rate has fluctuated between 35 and 39 percent this century.

Image by Business Insider

Gallup has long surveyed Americans about their reactions to the amount of federal income taxes they pay. Here's what they found:

63 percent of Americans thought they were paying “too much” federal income tax in 1962 when the top individual tax rate was 90 percent.

63 percent thought they were paying "too much" in 1985 when the top tax rate was cut to 50 percent.

63 percent thought they were paying "too much" in 2000 when the top tax rate was cut to 40 percent.

As you can see, there were fluctuations in attitudes during the 1990s, and Americans today are more inclined to think they are paying the "right amount" of federal income tax. Moreover, marginal rates are not the same as effective tax rates after deductions, though that has fallen for the top 1 percent of income earners as well.

The disconnect over the last century between steadily negative attitudes toward taxation, and decreasing top income tax rates, point to the power of American political culture. The country was founded through violent revolt in part over taxation. The U.S. political system was established with strong conceptions of individualism and limited government that permeate to this day.

This creates current tensions between increased demand for social services, such as basic health insurance for all Americans, and unpopularity of higher tax rates to help pay for these things. Tensions recently bubbled over into a testy shouting match among Senators Orrin Hatch and Sherrod Brown (a rarity in the Senate) over whose side lawmakers are on, the rich or the poor.

Photo by CNN

It is in this political climate Republicans seek to pass their tax cut bill, which leaves the top individual rate alone, while cutting taxes for businesses at an estimated $1.7 trillion public expense over the next decade, according to the non-partisan Congressional Budget Office.

Regardless of the ultimate fate of the GOP tax cut bill, efforts to reduce the $20 trillion debt America faces will likely fall short until Americans rethink their attitudes toward taxation, their expectations of government, or both.

This article was updated at 9:00am on November 19, 2017.

Luke Perry (@PolSciLukePerry) is Chair and Professor of Government at Utica College.

Taylor Raga is a Research Assistant at The Utica College Center of Public Affairs and Election Research.