NY-22 Minute: Central NY House Reps Explain Their Differing Tax Cut Votes By Luke Perry

Four GOP House Representatives from Central New York split over the first major piece of legislation passed under President Trump, The Tax Cuts and Jobs Act. John Faso (NY-19) and Elise Stefanik (NY-21) voted against the bill. Claudia Tenney (NY-22) and John Katko (NY-24) voted in favor of the bill. This reflects a larger split in the New York GOP delegation, most of whom opposed the legislation.

Reductions in the State and Local Tax Deduction (SALT) was the central concern for Representatives Faso and Stefanik, who were unwilling to support this due to the perceived negative consequences for their constituents, including citizens and business leaving upstate New York. Representatives Tenney and Katko were willing to accept the reduction, due to the perceived positive impact the bill will have in terms of providing tax relief and promoting economic growth. This piece will provide relevant thoughts of each representative in their own words.

Photo by The Hill

John Faso (NY-19)

Representative Faso issued a statement on December 18 explaining his “no” vote:

"From the beginning, I wanted to support a tax reform plan that would increase economic growth, increase worker paychecks, incentivize small business investment and ensure New York families are better off. Unfortunately, this plan does not meet all of those criteria, and I will vote against the bill when it comes up for a vote.

I remain concerned that as a result of the state’s high income and property taxes, the partial elimination of the SALT deduction effective January 1, 2018 impacts New York families more severely than those in other states. These families have already made financial decisions based on this deduction, and to have it removed without any chance to prepare, is unfair.

It's important to recognize that this bill does make positive changes in our tax code that will help American businesses of all sizes and their workers compete in the global economy. In addition, there will be many families and small businesses in the 19th district that will receive a tax cut under this legislation. However, the overall impact of changes to the SALT deduction will accelerate the trend of hardworking individuals and businesses already leaving our state – further eroding New York’s tax base.

I am pleased that changes I advocated for were made to the medical expense deduction, higher education affordability benefits, and private activity bonds in this final version in comparison to the House bill. Each of these provisions were primary concerns of mine because of their impact on families, students, and local economic development.

While there has been positive progress, I still cannot vote for the conference committee package due to my overwhelming concern with the state and local income tax deduction.”

Faso said: “it really was a tough decision. But I didn’t come down here just to be a trumpet for a political party.”

Photo by Will Waldron

Elise Stefanik (NY-21)

Stefanik issued a statement on December 18 explaining her “no” vote:

"I support comprehensive tax reform that provides relief for families and businesses in our district. I voted against the tax bill when it first came before the House because it did not provide enough relief for New Yorkers.

While progress has been made during the conference committee, the final bill does not adequately protect the State and Local Tax deduction that so many in our district and across New York rely on. Due to Albany's failed leadership and inability to rein in spending, New York is one of the highest taxed states in the country, and families here rely on this important deduction to make ends meet. Failure to maintain SALT could lead to more families leaving our region.

I will be voting no on the final legislation and will continue to work hard to ensure that hard working families and small businesses have their priorities represented in Congress. I thank the many constituents across the district who have contacted my offices to share their opinions on this important legislation.”

Representative Stefanik stated that “the bill we voted on was an improvement from the original bill. But at end of the day, I’ve been consistent about SALT remaining in the code." Stefanik explained: "I’m a Republican and I support cutting taxes, but I support tax cuts for 100 percent of my constituents."

Harvey Schantz, Chair of the political science department at SUNY Plattsburgh, explained that: "By voting against the tax bill, Stefanik is able to undercut some Democratic criticisms of her voting record, strengthen her bipartisan credentials, and choose constituency over party. It is simply not feasible to always toe the party line while representing a swing district."

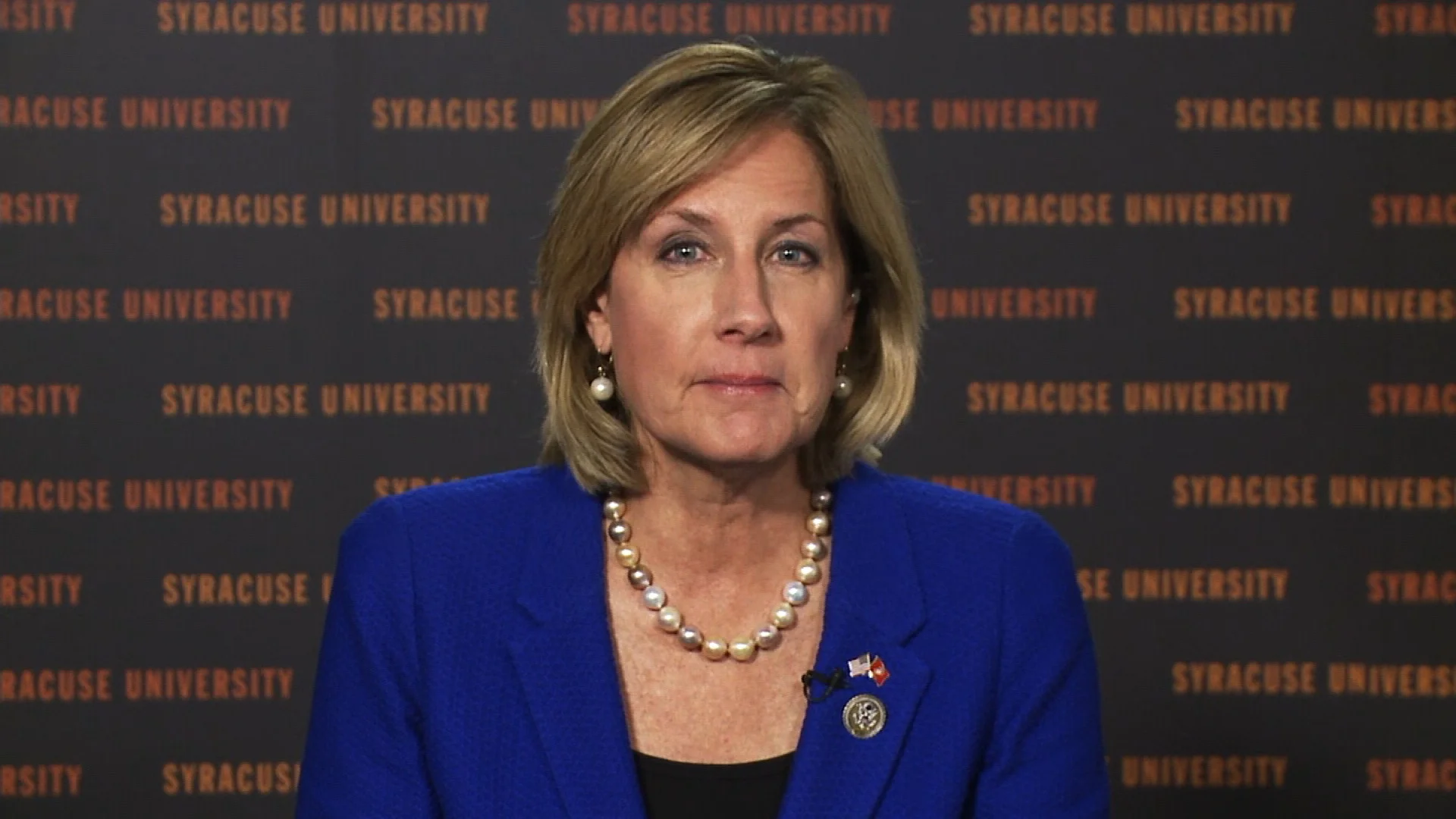

Photo by Wall St. Journal

Claudia Tenney (NY-22)

Representative Tenney issued a statement on December 19 explaining her “yes” vote:

“Tax reform is the key to unleashing the American Dream for all. Our current tax code is broken and riddled with loopholes that penalize success and hurt hardworking taxpayers. This changes today. The passage of the Tax Cuts and Jobs Act will provide critical relief to individuals and families while ensuring that job creators in 22nd District can compete on a level playing field. Our tax code will now reflect the values of fairness and hard work. Without these tax cuts, our economy will continue to be stagnant and American competitiveness will continue to suffer.

Doubling the standard deduction will encourage more Americans to claim this popular deduction and eliminate the worry and stress of itemizing taxes each year. The bill also lowers rates and preserves important deductions that New Yorkers rely on. This bill will benefit low- to middle-income individuals and families with a tax structure that is easier to understand and more generous.

Under this bill, the typical American family making $73,000 will see a tax cut of $2,059. A family with two children earning $52,967, the median household income in the 22nd District, would save $1,458, while a single filer with one child and an income of $30,000 would save $834. This means New Yorkers will receive an immediate raise in their January paychecks.

I fought an uphill battle to include provisions facing elimination that are vital to seniors, single parents, struggling families and overly burdened job creators throughout the debate on tax reform. Last week, I urged House and Senate leadership to retain the deductibility of up to $10,000 of property taxes, the federal Historic Tax Credit (HTC), and provisions allowing for the deductibility of medical expenses. Despite the fact that these provisions faced the very real threat of elimination and were not included in the original bill, my efforts were ultimately successful in securing the Historic Tax Credit, expanding the SALT deduction, and continuing the deductibility of medical expenses, to assist our most vulnerable seniors in defraying high medial costs.

In the 22nd District, where 99 percent of itemizers deduct less than $10,000 in property taxes, this provision will cover the overwhelming majority of property owners who own homes that are less than $450,000 in value.

The SALT deduction is so important because it shields New Yorkers from the oppressive burden Albany places on our taxpayers. Governor Cuomo and Albany politicians have zero respect for the taxpayers. The Governor and liberals in the Assembly continue to increase our already bloated budget, causing taxes to skyrocket year after year for hardworking New Yorkers. This bill will provide relief on the federal level while finally taking a step to encourage fiscal responsibility from Albany.

In my home state of New York, politicians in Albany have imposed one unfunded mandate after another on our local governments and local school districts. In turn, they have to pass this burden from the state down in the form of increased property taxes or cuts in services. This is wrong and it’s Albany’s fault. Nowhere is this more apparent than in the property taxes that my constituents pay. A 2013 study from the Brookings Tax Policy Center ranked more than 3,000 counties by their ratio of property tax to home value. All eight of the counties I represent in upstate New York, although far from wealthy, are in the top 36 nationwide. Cortland County comes in at No. 6 and Oswego County at No. 15.

For struggling families and small businesses, the status quo is not working. Passing this bill is the first step to providing desperately needed relief.”

Representative Tenney was questioned about by the bill by Ari Shapiro on NPR . Tenney was asked about why middle class tax cuts eventually expire, but corporate tax cuts do not, and how she explained that choice to middle-class Americans.

Tenney responded: “It's a tough choice. But in order to get corporations and pass-throughs, remember; corporations and pass-throughs are people. They're people who have run business. They're entrepreneurs. In order to get them to invest and put the billions of dollars back into our economy that we need them to do and to get - take advantage of those tax breaks, they're not going to be able to do it under the so-called reconciliation process, which has a 10-year window.”

Tenney was asked about many economists rejecting the notion these tax cuts will produce the level of economic growth necessary to pay for them.

Tenney responded: “Yes. Many more economists - actually almost all economists - are now saying if we're to continue the 3 percent growth that we're seeing now without even having the tax cuts passed, we're going to be eliminating that deficit. And not only eliminating, we could even see larger growth as we see the stock market continue to grow, we see more labor participation, we're seeing unemployment go down. All those things are going to be happening in a larger scale.

We're going to probably be seeing even greater than 3 percent growth, which - in a short period of time we're going to reduce the deficit, and we're also going to be reducing the long-term debt of this nation. Finally, growth is going to catch up. Next year, we're going to be reducing spending, which is going to be another aspect of this. But we desperately need this growth. We need to be repatriating the money that needs to be put into the American economy.”

Tenney was asked why an original goal of Republican tax reform, simplifying the tax code and eliminating loopholes, didn’t happen.

Tenney responded: “I think that one of the issues is we wanted to have deeper cuts and deeper cuts for the middle and lower-income taxpayers. We had to make a decision between simplification and deeper cuts, and we chose deeper cuts. When we get outside of reconciliation and we can grab some Democrats on the Senate side to join on to this, you're going to see even more growth coming forward.”

Photo by Tom Magnarelli

John Katko (NY-24)

Katko issued a statement explaining his “yes” vote:

“Today, with my support, the House passed the first major reform to our nation’s tax code in three decades. Throughout this process, I’ve fought for the best interests of Central New York and I’m proud to have delivered several significant wins. This bill safeguards the Historic Preservation Tax Credit, the income exclusion for graduate tuition waivers, and tax-exempt status for private activity bonds. It doubles the standard deduction, lowers individual rates, expands the Child Tax Credit, and importantly, preserves the local property and income tax deduction.

Despite the heated rhetoric surrounding passage of this legislation, the fact is that the status quo is simply not working for Central New York. Passage of this bill gives us a rare opportunity to level the playing field and put American workers first. I have always fought in the best interest of my constituents. I soundly believe this bill will deliver tax relief for Central New York families and allow local businesses to invest in our workforce. With the passage of this bill today, I’m excited to see our local economy grow and thrive.”

Representative Katko expressed confidence about the impact of the legislation. Katko stated that "the analysis is very, very solid - the vast majority of my constituents - particularly the middle class and the working class - are absolutely going to be getting a tax cut here. There's no question about it."

Luke Perry (@PolSciLukePerry) is Chair and Professor of Government at Utica College.

Read the NY-22 Minute for timely and comprehensive analysis of the campaign.